Kenya’s National Assembly has officially passed the Finance Bill 2025, moving it one step closer to becoming law after intense scrutiny, revisions, and public debate. The bill now awaits President William Ruto’s assent.

The legislative approval came after a comprehensive review by the Finance and Planning Committee, chaired by Molo MP Kuria Kimani. Lawmakers voted in favor of the bill, which forms the financial foundation for the Ksh4.29 trillion national budget for the 2025/2026 fiscal year.

A significant development during Thursday’s session was the removal of Clause 52, a controversial proposal that sought to grant the Kenya Revenue Authority (KRA) access to citizens’ personal and financial data. The clause would have repealed a section of the Tax Procedures Act that protects customer data from forced disclosure by businesses.

The clause had sparked fierce opposition from data privacy advocates, business owners, and members of the public. Critics warned that such access would infringe on individual privacy rights and create potential abuse of power. Treasury Cabinet Secretary John Mbadi had defended the move as a means to curb widespread income underreporting, but Parliament ultimately decided to drop the clause.

This decision marks a shift from the events of 2024, when President Ruto withheld assent to the Finance Bill 2024 after its passage triggered deadly nationwide protests. The demonstrations, led largely by the youth, resulted in a brutal police crackdown that left several protesters dead and multiple court cases pending to this day.

Learning from the backlash, the 2025 Bill has undergone a more consultative process, with Parliament acting cautiously to avoid similar unrest.

Beyond the contentious data clause, the Finance Bill 2025 includes sweeping amendments to the Value Added Tax Act, the Excise Duty Act, and the Income Tax Act. It also revises provisions within the Miscellaneous Fees and Levies Act, particularly regarding import declaration fees and railway development levies.

Treasury CS Mbadi, during his budget presentation, emphasized that the reforms aim to eliminate loopholes in tax laws and ensure a more equitable tax system. He assured the public that the measures would increase revenue collection while minimizing the burden on workers and businesses.

As the country braces for the economic impact of the new tax measures, all eyes are now on President Ruto, whose decision on whether to assent to the Bill will determine how Kenya moves forward with funding its ambitious 2025/2026 development agenda.

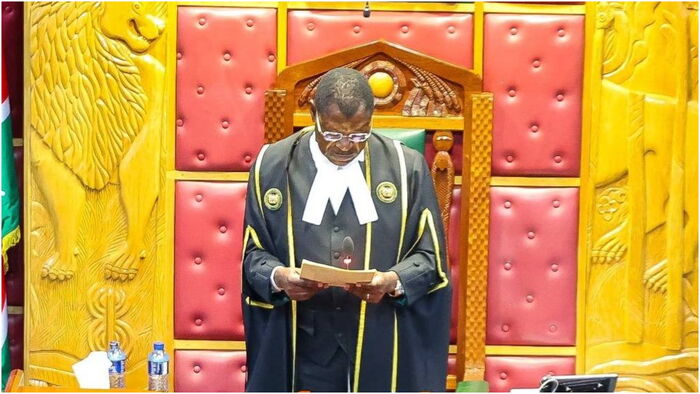

Photo: Parliament of Kenya

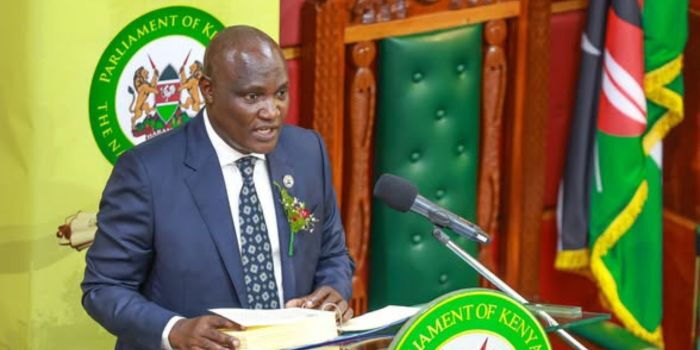

Photo: National Assembly